Sharing Risk, Rewarding Outcomes: The Environmental Impact Bond

Quantified Ventures has continued to iterate the Environmental Impact Bond model in the years since this blog post was published. For the latest information about Environmental Impact Bonds, click the button below.

Pilot or Scale New Environmental Innovations

Align Incentives of Stakeholders and Engage New Repayment Sources

Today, municipalities and other public-sector entities face increasingly complex multi-stakeholder challenges such as stormwater management, coastal restoration, and waste recovery. And for nearly all of these challenges, the longer we wait to address them, the more extensive and expensive they become. Yet, public budgets are strained and often unable to keep up with demand. Looking at infrastructure investment alone, we face a $1.4 trillion shortfall through 2025. Given the urgency and the stakes, municipal decisionmakers may not be eager to take on new risks, even for innovative—yet unproven—solutions that have the potential to address these challenges in cost-effective, environmentally friendly ways.

Share Risk with Private Investors to Protect Public Budgets and Taxpayer Dollars

The good news is that private investors are motivated to help. Increasingly, they are looking to generate positive social and environmental returns along with financial ones. In fact, from 2014 to 2016, there was 33% growth in impact investing assets, with $45 billion under management in North America alone.

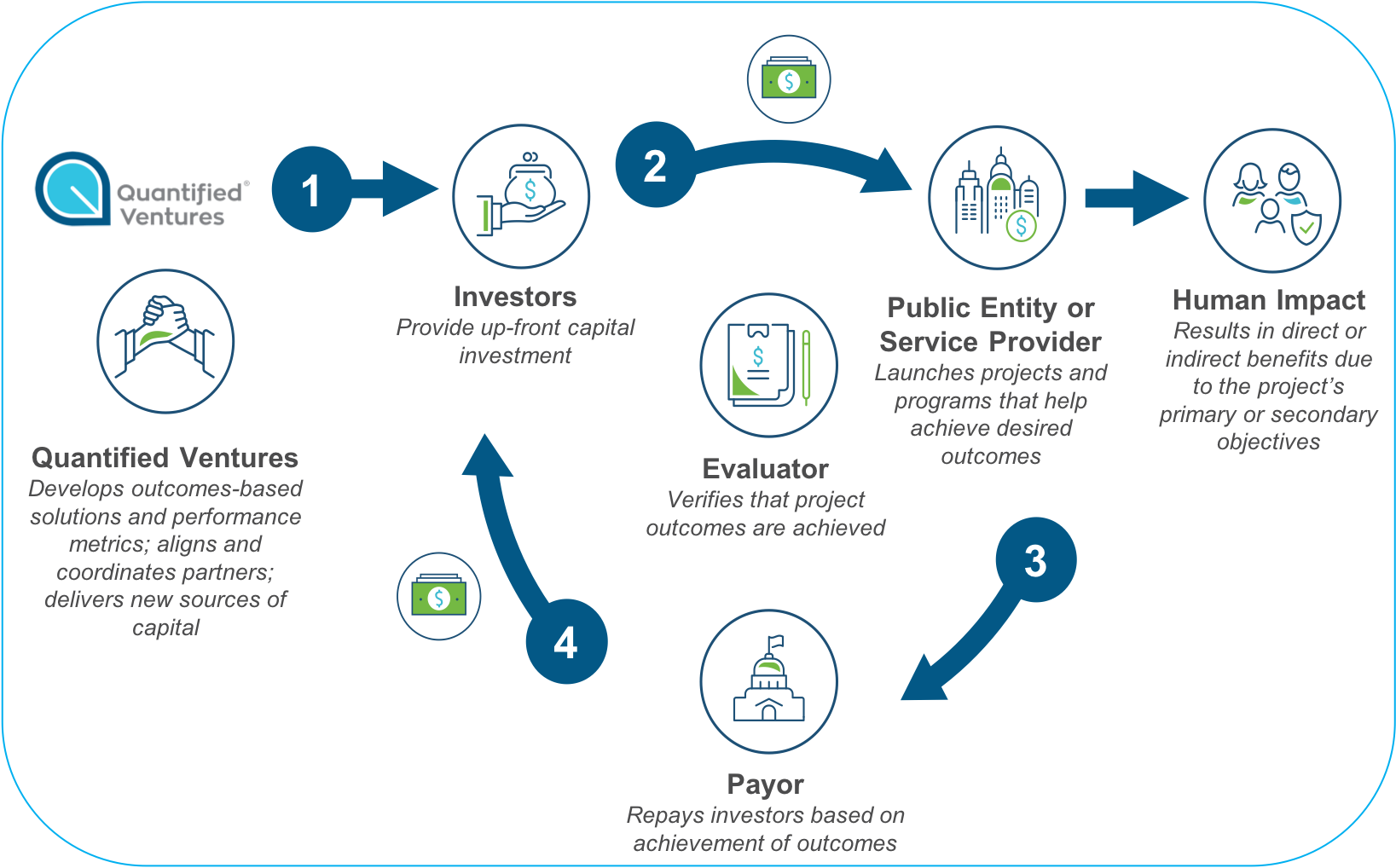

At Quantified Ventures, we serve as a bridge between this growing source of capital from impact investors and socially and environmentally impactful projects seeking to scale. We do this through outcomes-based financing, also known as “Pay-for-Success” or “Environmental Impact Bonds.” By negotiating purposeful partnerships between leaders across sectors, we are able to accelerate funding that will result in greater environmental, social, and economic benefits.

What is an Environmental Impact Bond?

An Environmental Impact Bond (EIB) is an innovative financing tool that uses a Pay for Success approach to provide up-front capital from private investors for environmental projects, either to pilot a new approach whose performance is viewed as uncertain or to scale up a solution that has been tested in a pilot program.

In its most basic form, investors pay the upfront costs for deploying these environmental solutions. Following deployment and program evaluation, the “payor”—whether it’s the public agency or private institution that benefits from these solutions—repays investors an amount linked to the achievement of agreed-upon outcomes of the program. The bond structure is designed to meet the payor’s needs—whether that’s providing risk coverage in the case of underperformance, or a benefits share with investors and contractors to incentivize exceeding performance.

If the project performs as expected, we’ve learned that the intervention is effective. If outcomes are better than expected, the payor knows they’re getting an even greater return than expected on their investment, and they can alter future investment plans to recognize savings from doing fewer, more effective projects. If the project underperforms, some projects require investors to make a performance payment back, providing some insurance to the payor and room to change course by allocating the recouped costs. By identifying, quantifying, and transferring project risks, the EIB creates incentives to deploy innovative solutions.

Who it benefits:

Issuers, such as municipal agencies, can use EIBs to fund projects viewed as “risky” by leveraging private capital and sharing risk with private investors, learn about performance, and engage additional payors to share project costs.

Investors can use EIBs to support critical environmental priorities while receiving a risk-adjusted return.

Service providers are given a new way to finance projects that further their mission and impact.

Who can issue an EIB:

Public agencies at the local, county, state, or federal level

Private companies

Others

How Environmental Impact Bonds are used today

In 2016, Quantified Ventures introduced the first-ever Environmental Impact Bond with DC Water and is now working with cities across the U.S. to help them tap into impact investment for environmental projects.

DC officials celebrate the groundbreaking of a green infrastructure project financed by an Environmental Impact Bond.

DC Water

Like 772 communities across the country, the nation’s capital has a combined sewer system. This means that since both raw sewage and stormwater flow through the same pipes into DC Water’s treatment facility, 2 billion gallons of sewage overflows directly into the Chesapeake Bay Watershed annually. Though DC Water’s solution was a $2.6 billion tunnel system designed to prevent the overflow from entering rivers, they learned halfway through the 20-year project that green infrastructure (e.g., rain gardens, permeable pavement, green roofs, and rain barrels) was a viable, innovative alternative. However, green infrastructure had never been deployed at this scale before, leaving DC Water with questions and concerns around risk. DC Water turned to Quantified Ventures to model and advance this first-of-a-kind transaction. We brought in impact investors to share the risk by investing in the nation’s first EIB, a $25 million tax-exempt bond sold in a private placement to Goldman Sachs Urban Investment Group and Calvert Impact Capital.

Atlanta Mayor Keisha Lance Bottoms announced the city's first Environmental Impact Bond.

Atlanta

Atlanta Mayor Keisha Lance Bottoms announced in March 2018 at the 17th Annual Parks & Greenspace Conference that the city’s Department of Watershed Management will use EIBs to finance green infrastructure projects which will improve the resilience of an area that has been devastated by flooding in recent years. Atlanta was selected as part of a competitive process sponsored by the Rockefeller Foundation in which cities applied for pro bono support setting up EIBs to finance their city’s environmental projects. "I am pleased the City of Atlanta is the first winner of the Environment Impact Bond challenge," said Mayor Bottoms. "My administration will fully maximize the community and economic benefits of this investment to help restore pride in the Proctor Creek Watershed for Westside neighborhoods." Through a partnership with municipal bond broker-deal Neighborly, the city will become the first-ever municipality to issue publicly offered EIBs, allowing citizens to become investors in their own city.

Representatives from Quantified Ventures, the Chesapeake Bay Foundation and Baltimore announced the city's first Environmental Impact Bond on a future green infrastructure site.

Baltimore

Stormwater is the only major source of nitrogen pollution still increasing in the Chesapeake Bay watershed. To address this, the Chesapeake Bay Foundation (CBF) is working with Quantified Ventures to introduce local Bay jurisdictions to a new way of financing green infrastructure for stormwater management. Baltimore was chosen as part of a competitive process sponsored by CBF, which has raised support for this project from the Kresge Foundation and an anonymous donor to provide pro bono support to Chesapeake Bay cities to set up EIBs. In March 2018, Baltimore’s Department of Public Works Director Rudy Chow (at podium in photo above) announced from a green infrastructure site in the Harlem Park neighborhood of Baltimore, that EIB financing will help Baltimore fund 90 special landscaping projects in more than three dozen neighborhoods. The built-in accountability of the EIB was attractive to the city government, as was the opportunity to learn about how to manage operations and maintenance costs of green infrastructure projects over time. This approach could be applied throughout the Chesapeake region to meet water pollution goals and improve neighborhoods.

Wayne National Forest is employing the Environmental Impact Bond model to finance a new mountain bike trail.

Wayne National Forest: Athens, Ohio

Rural investing is hard. Nearly 80 percent of U.S. venture capital goes to San Francisco, New York, and Boston. Ohio’s 3C’s (Cleveland, Columbus, and Cincinnati) often struggle to get access to investment capital, and it’s even tougher for places like Athens county, Ohio’s poorest county labeled “economically distressed” by the Appalachian Regional Commission (ARC). Through a competitive process, the Wayne National Forest — located in the hills of Southeast Ohio — was selected as a promising investment candidate among various US Forest Service sites. We are now assessing the feasibility of financing an 88-mile single track mountain biking trail designed for all level riders by tying investor repayment to economic development outcomes and increased tax revenues from tourist spending. These outcomes would include increased spending by visitors, resulting in increased earnings and job opportunities for the region. Quantified Ventures is proud to be working with the U.S. Forest Service on this project to determine whether “Pay for Success” could be used to fund recreational infrastructure.

Representatives from Quantified Ventures, EDF, and Port Fouchon doing research on the Louisiana Coast.

Environmental Defense Fund

To address the world’s most pressing environmental challenges, we must catalyze large-scale private investment in innovative environmental solutions. One place where such solutions are greatly needed is Louisiana, where more than 2,000 square miles of coastal land have vanished since the 1930s. While billions of dollars associated with the 2010 Deepwater Horizon oil spill are flowing to Louisiana for restoration, those funds—which will be deployed over the next 15 years—are insufficient to address all of Louisiana’s coastal restoration needs. To help address these needs, Environmental Defense Fund, together with Quantified Ventures and with input from Louisiana’s Coastal Protection and Restoration Authority, evaluated the feasibility of an EIB to support wetland restoration. The EIB approach demonstrates how the private sector can partner with government to implement coastal resilience projects in Louisiana sooner while generating a financial return for investors. It has the potential for replication to support restoration of coastal areas across Louisiana, in other Gulf states and beyond.

Is an EIB right for you?

Many organizations reach out to us wondering if an EIB makes sense for a given environmental issue they are working on. If you have a project—such as green infrastructure or a new recreational intervention—waiting in the wings for budgeting approval and delayed revenue streams, the EIB could be the solution for you.

While there is no one model for structuring an EIB, some key questions we consider include:

Model Fit

Is there a new environmental intervention perceived as risky that needs to be piloted? OR Is there a proven intervention that needs to be scaled?

Do stakeholders have aligned interests but need incentive to work together?

Is an EIB the easiest, cheapest way to finance this project?

Is the transaction large enough to warrant an EIB (~$2-3M+, $5M if bond issuance)?

Are at least some stakeholders driven by regulatory requirements related to the environmental issue at hand?

Stakeholder Capabilities and Buy-in

Is there a champion willing to fight for innovation?

Is there a revenue source that can be allocated to repayment?

Is there a clear outcome that will interest investors?

Measurement & Modeling

Can the desired outcome be measured quantitatively?

Can that outcome be valued financially?

These questions don’t always have easy answers. We work with our clients to explore the feasibility of the EIB approach and to tailor a transaction structure to the local context and stakeholder goals.